The problem with mass marketing has finally been solved. The answer is programmatic advertising.

Imagine two neighbors. Both watching ESPN. One sees your ad. The other doesn’t. The first is your target audience. The other isn’t.

The promise of programmatic advertising has finally reached marketing nirvana. The age-old problem of wasting 50% of your marketing budget on zero-value impressions is over.

A Brief History of Programmatic Advertising

2007… the release of Apple’s first iPhone. And the year Android’s mobile operating system was released. Early mobile screen adoption had been slow, but these two releases catapulted the market. It only took five more years for the inflection point, when 2012 was dubbed “the year of mobile.”

Programmatic advertising, since the late 90s, had been waiting for a similar catapult, and 2020 brought it. While total ad spend in programmatic had grown by double digits each year since 2017, those in the know say it got the big boost from the pandemic, allowing 2020 to be dubbed, “the year of programmatic.” What was the inflection point?

A Convergence of Programmatic Events

In 2017 — ten full years after Google’s big bet when it bought the digital ad exchange, DoubleClick — the inflection started. The downsides of programmatic advertising had been acknowledged and to a great extent, remedied. Consumer adoption of “new” services and about a half dozen technological enhancements made programmatic attractive to advertisers… again. Here’s a list of a few of those happy occurrences:

- Streaming Goes Mass:

Consumers were finally adopting streaming services en masse, creating a sufficient size audience to segment and therefore, target. “Cutting the cord” was no longer just for early adopters. Connected TV (CTV) services such as Hulu, YouTubeTV and Sling gained millions of subscribers seemingly overnight. Programmatic advertising platforms, such as the Trade Desk, added CTV as one of its core offerings, thereby adding the “last” and most important screen. Because CTV is served over the internet, the TV “screen” simply became another browser that could track user activity. Therefore, creating individual user viewership profiles (demographics, geographics, psychographics and firmographics) meant targeting consumers was possible at an IP — meaning, household-by-household — level.

Meanwhile, streaming audio such as Spotify, Pandora, XM/Sirius Radio and podcasts started to consume as high as 40% of mobile device time. Also served via the internet, audio listening habits/interests added another dimension to the online user profile. As it become available on programmatic advertising platforms, demand skyrocketed.

With TV and audio added to the mix, the last bastion of content consumption was now “connected.”

- Targeting on Steroids:

Along with the convergence of consumer streaming activity, targeting matured considerably. Cross-device tracking was enhanced to reduce the number of online profiles of the same consumer, providing an incredibly rich “consumer unit” to target. For example, a visit to a website (via any device) is now able to be attributed to the same consumer who saw a CTV spot on her smartTV, heard a streaming audio ad on her tablet or saw an in-app banner ad on her phone.

Advertisers can now model their first-party customer database to find look-alike users. A database of 100,000 customers can be used to find another million consumers who might have a profile with similar demo-, psycho- or firmographics. Combining that with geo-targeting made programmatic advertising a marketer’s dream.

This level of targeting is at the heart of the above scenario — displaying an ad to one household watching ESPN while ignoring the other. - Finally, Big Data Tracking Comes of Age:

New programmatic advertising platforms began to leverage artificial intelligence to process trillions of data points to return an advertiser’s target in a real-time bid process. In milliseconds, automation determines if the consumer profile fits the target attributes, who has the highest bid, and returns the right ad format for consumption.

After the ad has been served, any and all actions taken by the viewer are captured and the behavior continues to build the online consumer profile. Optimization is tracked based on conversion, creative version, ad format, frequency, device, day-part and dozens of other stats to layer on top of the user profile.

"Big data optimization” made the advertisers job easy, and accurate. No one could argue which ad or offer worked. The data proved it.

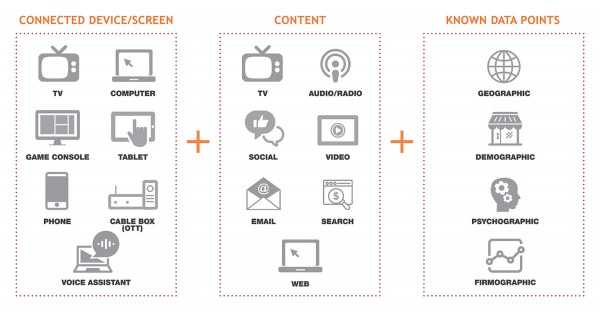

Visualizing Programmatic Advertising

If you’re new to programmatic advertising, this infographic shows the basic components of an online consumer profile. It combines the screens used by the consumer, the content consumed and in-depth geographic, demographic and psychographic data points. This powerful combination allows an advertiser to target audiences in a very precise manner (B2C or B2B).

The COVID Boost

2020 isn’t a year any of us will remember fondly. However, it supercharged programmatic advertising. Lockdowns meant more screen time on all devices. Like the hyper-adoption of Zoom, Microsoft Teams and other web conferencing software, programmatic shot up almost 10% over 2019, a rather amazing increase given that 49% of all ad dollars in 2019 were already spent in digital advertising. Linear advertising (aka traditional media) fell over 16%.

According to eMarketer, 84.9% of the US digital display ad market was spent on programmatic ads in 2019. And this number is predicted to rise to 88% by 2021 to reach $81 billion in the U.S. alone.

Now that digital advertising is more than half (58%) of all ad spend, and programmatic is almost 88% of digital, it’s fair to bestow the title of 2020 as the “year of programmatic.” The inflection point is now complete.

“We’re well past the years of brand safety issues, ad fraud and privacy breaches,” said Rose Browning, Director of Media Services at Innis Maggiore. “Programmatic has changed media buying and it’s only going to increase as a portion of advertisers’ budgets. I think once advertisers are used to being able to turn on and off their ads based on proven success — and do so in a matter of minutes — they will keep using these methods.”

Browning continued, “The C-suite wants accountability more than ever. With the frequency of business environment changes and demands from clients, advertisers have to be more responsive than ever. If the CEO says go, we might be asked to deploy a new campaign within a few days. Rare will become the days of 6-month production shoots and upfront media buys.”

The programmatic advertising revolution is here. Advertisers now understand the power of the stitching together of screens into a single investment decision and a single view of the customer.

Targeting is so powerful through programmatic advertising that even B2B advertisers — reticent to include TV and radio/audio in their campaigns — have started to migrate significant advertising dollars to these media through programmatic platforms. To learn more why B2B advertisers are migrating to programmatic, read this bonus article.

With all the change that came in 2020 and more people in front of screens than ever before, it was certainly programmatic’s year to shine.

Innis Maggiore offers connected TV, audio advertising, display, social, native, paid search and other programmatic media strategy, planning and buying. For a FREE consultation to see if programmatic might be right for you, contact Mark Vandegrift.

P.S. For all you data nerds! If you want to see a full data assessment of 2020 against previous years and across the globe, download MAGNA’s Global Advertising Forecast (updated Dec. 7, 2020) here.